Click here to go directly to our Prospectus

Mailing address for donations: Zoe’s Wings Foundation, Inc. 712 S 32nd Street, Temple, Texas 76501

Donations and Fundraising

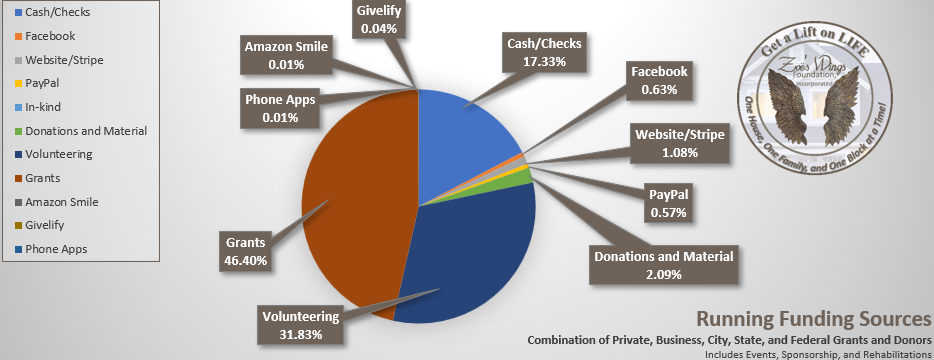

Zoё’s Wings Foundation, Incorporated is a 501(c)(3) public charitable organization and solicits and relies on grants from private foundations and donations to support our charitable activities. We also derive our financial support by raising funds from the public through individuals, governments, corporations, and private foundations. Donations from individuals, organizations, businesses, and corporations receive a tax deduction for your generous gift.

Your charitable giving is vested in the community as a need is brought to the board for review. The funds are used for materials and labor. Once the need is assessed and approved, workers or volunteers are scheduled to complete work, or funds are distributed according to our guidelines.

Your donation can come in the form of a house with property taxes due, is damaged, has maintenance liability, or has been an inherited strain on your wallet. For a tax write-off, we can relieve that stress from you by making a donation or purchasing it from you.

Thank you for your generosity!

Prospectus

Sponsors and donors, please view Zoe’s Wings Rehabilitation Prospectus here:

Other ways to give:

Donors and Partners

Our strength is in our community partners, whether individuals, businesses, corporations, city, state, and government. Your support makes our vision possible. Thank you for loving what we do!

2019-2023 Donors (* In Kind) (** Grant) (*** Volunteer hrs) (****Tornado Relief)

$100,000 +

City of Temple- CEG**

$50,000 to 100,000

$25,000 to $49,000

ZGL Engineering Svcs*

Zoe Grant ***

$10,000 to $24,999

$5,000 to $9,999

Kenneth Whipple

Cadence/FHL Bank of Dallas**

Walmart Facility 6083**

Walmart Facility 6929**

Daryll and Cassie J Williams

$1,000 to $4999

Barbara Pollock & Carol Mouche’ (Schwab Charitable)**

Cadence Bank Foundation**

Covenant Lutheran Church

Covenant Lutheran Church***

Walmart Facility 3449**

Walmart Facility 3319**

Walmart Facility 1232**

Walmart Facility 746**

Tiffany Brown*

Len and Ruth Henry

Elaine Mosley

Joyce Marcum

The Fikes Foundation**

SBA**

First Baptist Church Temple

Land Investor, LLC

Superior Healthplan**

Temple Founders Lions Club

$1 to $999

A New Day Fellowship Church*

Accent Realty

Amazon Smile

Amos Electric

Bonnie Bogs

Budweiser*

Central Texas Christian School ***

Central Texas Christian School

Central Texas Food Bank – Gill Hollie*

Esther’s Daughters

$1 to $999 cont.

H&D Distributors, Inc (Dallas)

Jorden Anderson Non-Profit Consultant ****

Land Investor, LLC

LJT Texas L.P.

Network For Good

Steele Monroe

Rudy’s Construction*

Presbyterian Children’s Homes and Services

The 411 House*

Walmart 6336**

Walmart -Gill Hollie**

Women of the ELCA

Un-Included Club

Kelly Atkinson*

Christina Ballard

Colleen Banks

Donna Bowling

Ed Briscoe

Dina Brown *

Maya Brown

Tiffany Brown *

Barbara Butler

Tremeka Carey

Ron Carr

Kimberly Chiles

Brenda Clark

Heidi Clausen*

Tamara Clothier

Delise Coleman

Davetta Cross

Caleeah Curley

Liz Dickinson

David and Linda Domelsmith

Frank and Anna Jaworski *

Zoe Grant *

Georgia Guderyahn

Jo-Ell Guzman

Venita Johnson

Lendy Jones

Jeff Lawyer *…….

GC Hardin

Ora Hudson

Jai Jackson

Keta Key

Jeanne Kuehn

Tasha Lajeanna

Valerie Love

$1 to $999 cont.

Marilyn MacDougall

Micahel McDaniel

Cean Mack

Clarence Marion

Sandra McIntyre

Beth Mercer

Michael & Jean Milbery

Margaret Neal

Barbara Pollock & Carol Mouche’ (Schwab Charitable)**

Gary & Linda Rapp

Zoe & Terry Rascoe

Estela Ortiz

Dionne Sanders

Tiffany Savage

Cordelia Smith

Diane Smith

Willie and Sharon Stermer*

Jane Snodgrass

Landrey Terry Jr.

Andrea D. Thomas

Martha Tyrode *

La Shunda Walker

Rhonda Ward*

Wanda Whitley

Cassie Williams

Dionne Vaughns

Keith Young